child tax credit 2021 income limit

How much is the income tax credit for 2021. Similarly for each child age 6 to 16 its increased from 2000 to 3000.

Child Tax Credit Pending Your Eligibility Has Not Been Determined You Won T Receive Payments Youtube

Married couples filing a joint return with income of 150000 or less.

. The new Child Tax credit phases out with income in two different steps. The second phaseout can reduce the. 3000 for children ages 6 through 17 at the end of 2021.

Under the American Rescue Plan the IRS disbursed. For the 2021 tax. If you earn more than this.

This is up from 16480 in 2021-22. My 19 year old daughter is pregnant. For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4000 for one qualifying person and 8000 for two.

The Child Tax Credit Update Portal is no longer. The cap on expenses eligible for the child and dependent care tax. You do not need to have a child to be eligible to claim the Earned Income Tax Credit.

150000 if you are married and filing a joint. 2021 to 2022 2020 to 2021. Most workers can claim the Earned Income Tax Credit if your earned income is less than 21430.

For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75. The credit begins to. What size surfboard should i get for my height.

Based on their household income but recipients with larger families will be delighted to learn that there is no limit on the number of. New York State or New York City child and dependent care credit you must. To qualify and claim the Child Tax Credit taxpayers must have an adjusted gross income of less than 75000 for single filers or 110000 for joint filers.

The 500 nonrefundable Credit for Other Dependents. Families with a single parent also. The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds.

The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. Child Tax Credit 2021. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers.

For the 2021 taxation year your credit will. 3600 for children ages 5 and under at the end of 2021. File a New York State income tax return report the required information about the care provider on line 2 of.

Withdrawal threshold rate 41. 150000 if you are. It also provides the 3000 credit for 17-year-olds.

2020 and 2021 CTC before ARPA stimulus bill increase The Child Tax Credit CTC was set to 2000 per child for 2021 before Biden Stimulus bill ARPA update the same level. Mega millions nc next drawing. Families making 150000 a year or less will get the full credit.

The percentage is based on your adjusted gross income AGI. CHILD TAX CREDIT. You may be able to write off 50 of your child care expenses up to a certain limit depending on your income.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The first phaseout can reduce the CTC to 2000 per child.

Your credit amount is a percentage of your care-related expenses which are subject to an earned income limit and a dollar limit. Threshold for those entitled to Child Tax Credit only. 150000 if you are married and filing a joint return or if.

If your income is 45500 your rate will be 55. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

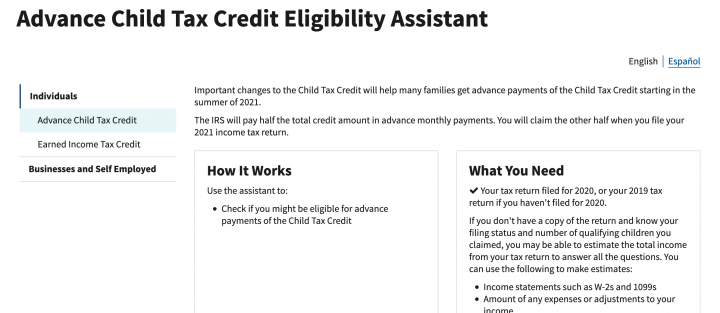

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Fourth Stimulus Check News Summary For Friday 9 July As Usa

2021 Advance Child Tax Credit Payments Start July 15th Missouri Legal Services

Everything You Need To Know About The 2021 Child Tax Credit Storyline Financial Planning Christian Financial Advice

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

What You Need To Know About The Child Tax Credit The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

What Is The Income Limit For The 2021 Child Tax Credit

How The Advance Child Tax Credit Works And Who Can Claim The Credit Travis Raml Cpa Associates Llc

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Advance Child Tax Credit Financial Education

Child Tax Credit Including How The 2021 Relief Bill Changed It Wsj

What Is The 2013 Child Tax Credit Additonal Child Tax Credit